Starting to analyze the current state of the S&P 500, one may notice a peculiar trend forming. An interesting pattern emerges that investors often refer to as a ‘bear flag’ when conducted through technical analysis. The suspicion that a bear flag pattern is forming in the S&P 500 is gaining considerable attention among seasoned investors, prompting a larger conversation around its implications and possible outcomes for the market.

The bear flag pattern is a negative signal in the context of financial markets, often indicating that a downtrend is on the horizon. For those not familiar with technical analysis, a bear flag pattern comes into shape when prices rally slightly after a large downfall, forming what is called a ‘flagpole’. This is followed by another drop in prices, creating a rectangular shape, or ‘flag’, making the entire pattern resemble a mast on a ship with a flag fluttering in the wind.

Examining the S&P 500’s recent performance, we can see that there was a substantial drop in the index, which marked the creation of the flagpole. This fall was followed by a slight upward movement, giving shape to the rectangular flag. This pattern may suggest that the market is on the brink of a further downtrend, creating potential cause for concern among investors.

However, before any hasty conclusions are drawn, it’s imperative to remember that patterns such as these are not predictive, but probabilistic. While the bear flag suggests a further downward trajectory, it doesn’t guarantee this outcome. Market conditions are influenced by a myriad of factors, and patterns merely provide a tool to aid in forecasting possible scenarios, not unerring prophecies.

This being said, the appearance of such a pattern should instigate further scrutiny and guide investors’ decisions in the forthcoming weeks. Particularly, investors should tighten their risk management strategies. This may include setting stop losses at strategic levels, diversifying their portfolios, or seeking investment opportunities that thrive during bearish market conditions.

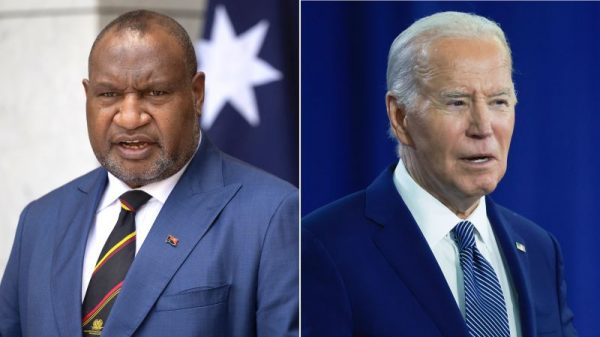

As for the potential causes of the speculated bear flag formation in the S&P 500, it could be attributed to various factors. The ongoing impact of the COVID-19 pandemic, the unpredictability of inflation, potential changes in fiscal policy, and geopolitical tensions are all significant contributors to market sentiment and performance. The pattern could simply be reflecting these encompassing uncertainties.

Furthermore, with high-valued stocks in sectors such as technology being heavily represented in the S&P 500, their vulnerability to market fluctuations could potentially be fueling the bear flag signal. These sectors are often the first to bear the brunt of economic unease, thus the performance of such stocks can significantly influence the overall direction of the index.

The S&P 500’s possible bear flag pattern should be taken seriously, as it can serve as a herald of market conditions to come. However, investors should not use it as their sole tool for decision making. While it provides a valuable insight into future market trends, it’s one piece of the puzzle in the multifaceted a dynamic world of investments. It is crucial that investors balance their reliance on technical analysis with comprehensive research into the economic climate and developments within specific sectors.

In conclusion, while the S&P 500 might be currently showing signs of a bearish flag pattern, indicating a possible downtrend, only time will tell how this prediction manifests. Investors are advised to stay alert, manage risk efficiently, and remain adaptable in the face of change. It is important to remember that the financial markets, being the complex entities they are, can always take an unanticipated turn.