Disney: Bust or Bargain?

Articulating concerns around Disney’s financial health is no small task, especially for an entertainment conglomerate that has ruled the market for the better part of a century. However, with the current global economic scenario coupled with operational hurdles, it’s crucial to question: Is Disney a bust or a bargain? Depending on whom you ask, the answers may vary extensively which is why it is crucial to consider the different factors at play and levels to watch keenly.

To begin with, let’s examine Disney’s financial performance for some context. Disney’s latest quarterly results have garnered widespread attention not just for the raw numbers but also the trends they reveal. Though the company reported mixed results with its earnings, there has certainly been a significant performance boost from its streaming service, Disney+. Disney+ had more than 128 million subscribers at the end of its third quarter in 2021, translating into an over 100% increase from the previous year. This speaks volumes about the strategic shift towards digital distribution and the successful adoption of the same by its consumers.

Nevertheless, the pandemic’s impact on Disney’s legacy businesses – mainly theme parks and motion pictures – cannot be understated. Shut-downs and disruptions caused by COVID-19 had a far-reaching effect on the company’s revenue, with these two divisions taking the hardest hit. Disney’s theme parks saw a staggering operating loss of $1 billion in Q4 of 2020. Although the amusement parks have been reopening gradually, the recovery is likely to be slow and also dependent on the global wellness scenario.

Peeking into Disney’s motion pictures venture, it’s an undeniable fact that this division was hit by theater closures and production halts. However, Disney seems set to leverage its film catalog, with a strong movie lineup set for release in the coming years. Furthermore, Disney has been experimenting with new release strategies, such as simultaneous release in theaters and on Disney+.

Investors need to pay close attention to how these strategies translate into revenue before placing their bets. Take the instance of Black Widow; its earnings got a boost from Disney+’s Premier Access charge, reflecting on the potential of this hybrid model. Yet there has also been controversy and legal complexities which can impact the future execution of this model.

A significant level to watch is Disney’s debt. The company has greater leverage than many of its competitors. By the close of 2021, Disney’s total debt had accrued to around $65 billion. However, with a steady revenue inflow and operating income, it might be capable of paying off its obligations over time.

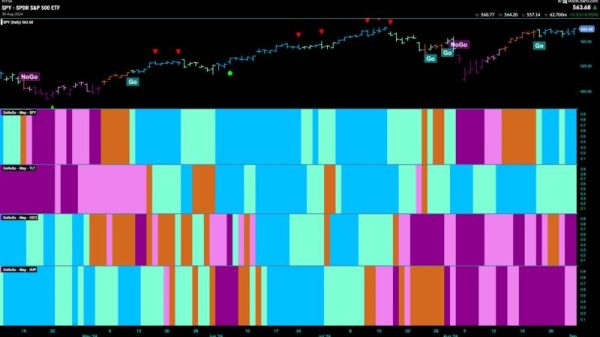

Disney’s stock price, arguably the most critical level to watch, has presented a mixed picture in recent times. Post-2020 saw the price surge with the roll-out of Disney+, but recent months have seen a slight decline due to underwhelming earning results and questions around growth.

To decode whether Disney is a bust or a bargain, one may need to closely watch these levels – the streaming service subscriber base, revenue performance of theme parks and movies, the evolution of its hybrid release model, the company’s ability to manage debt, and the fluctuation in stock prices. There are splendid opportunities in the midst of challenges. Seeing how the future unfolds for Disney, with its mix of legacy businesses and new ventures, will indeed be nothing short of a gripping spectacle.