The world of gold trading has always been fascinating for investors. Gold, known for its stability and relatively low volatility, has proven itself over the years as a trusted safe haven asset in times of economic uncertainty. However, the conditions that affect the gold market can sometimes lead to significant spikes in the gold price. The highest price ever recorded for gold occurred not so long ago, in the year 2024.

In August 2024, the price of gold skyrocketed to an all-time high of $2,960 per ounce. This price leap represented the pinnacle of a long-term trend that had been partially driven by the economic repercussions of the COVID-19 pandemic which started in late 2019.

A series of unprecedented economic conditions led to this record-breaking price. Firstly, the lingering effects of the pandemic continued to disrupt global economic stability, generating significant demand for gold as a safer investment option. Inflation rates in many developed economies were also increasing, with investors turning to gold as a traditional hedge against inflation.

Secondly, geopolitical tensions around the globe were contributing to the economic anxiety felt worldwide. Conflicts in Asia and political uncertainties in Europe showed no signs of abating, sending tremors through global markets. As such, many investors flocked to the safe haven asset, further driving up the demand for gold.

Thirdly, there was a noticeable decline in production from major gold mining companies. Environmental regulations, labor disputes, and declining ore grades inexorably increased costs and lessened output. With supply unable to match the surging demand, this shortage created a perfect storm propelling gold prices to their historic highs.

Interestingly, digital currencies and other ambitious financial technologies, once seen as threats to the relevance of gold, played roles in the 2024 price hike instead. Many investors, disappointed by the notorious volatility of cryptocurrencies such as Bitcoin, returned to gold as a stable store of value. Although digital assets have certainly transformed financial markets, they somehow reinforced the appeal of gold and its established status in the global financial system.

The central banks’ behavior also played a pivotal role in the gold price surge of 2024. A combination of expansionary monetary policies and increased gold reserves by numerous central banks worldwide drove up the demand for gold. The banks were reacting to predictions of a possible economic crisis, which further fueled the hike in prices.

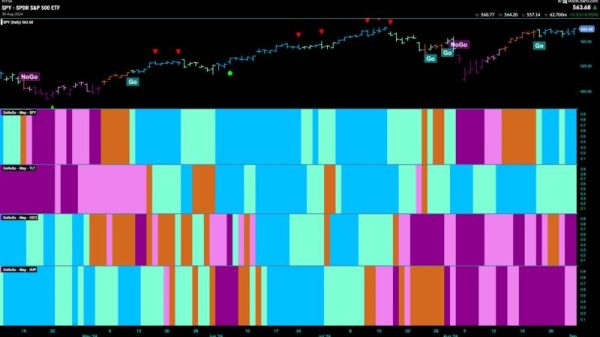

Finally, the influence of the gold ETFs (Exchange Traded Funds) market was another critical factor. ETFs, by their design, allow for easy trade of underlying assets such as gold. The ETF market for gold expanded significantly, which had the effect of increasing both liquidity and demand for gold.

The record-breaking price of gold in 2024 underscored the metal’s enduring appeal. Its performance underlines its status as a go-to asset in times of economic tumult and its invaluable function in hedging against various economic risks. Since then, gold prices have normalized to an extent, but the 2024 all-time high of $2,960 per ounce remains an extraordinary peak and a critical reference point in the history of gold trading.