When it comes to investing, one tried and true method adopted by many investors to maximize their return is the buy-the-dip approach. This strategy entails capitalizing on price drops in an asset or the market as a whole to increase one’s holdings at a lower cost. To efficiently utilize this, an investor needs an investment routine that accurately spots these opportunities.

I. Adopt A Long-Term Perspective

The main prerequisite for spotting buy-the-dip opportunities is approaching investments from a long-term perspective. This perspective is essential because, while an asset’s value can fluctuate wildly over short periods, the long-term trajectory tends towards appreciating in value. A long-term approach provides the cushion needed to weather market volatility and take advantage of price dips when they occur.

II. Understand Your Investment

For successful buy-the-dip investing, understanding the fundamentals of your chosen investment is critical. For instance, if investing in stocks, one should be conversant with the company’s financial health, market position, and industry dynamics. This understanding allows you to distinguish between a temporary slump and a fundamental issue potentially causing a long-term decline, allowing you to make a more informed buying decision.

III. Regularly Monitor The Market

Being up-to-date with market trends and news is vital. Every event from policy changes, quarterly earnings reports to geopolitical events can cause stock prices to fluctuate. By staying informed, you can discern whether a price dip is a buying opportunity or a signal to retreat.

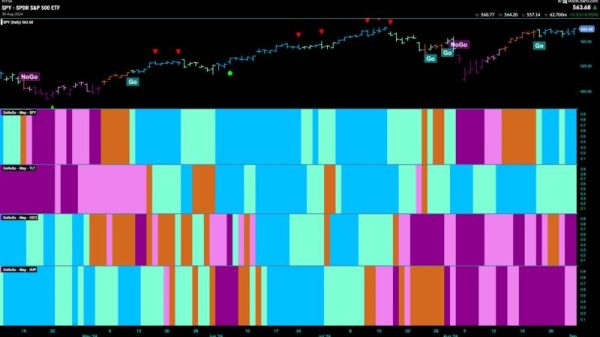

IV. Utilize Technical Analysis

Technical analysis involves studying price charts and technical indicators to predict future price movements by identifying patterns and trends. Strategies often used in this analysis include tracking moving averages and volume trends, or noting support and resistance levels. Mastery of these techniques can help you spot potential buy-the-dip opportunities before they fully materialize.

V. Use Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy where an investor divides up the total amount to be invested across periodic purchases of a target asset regardless of its price. This method reduces the impact of volatility on the overall purchase. Hence, instead of trying to time the market, regular investments are made, and, over time, more shares are bought when prices are low and fewer when prices are high.

VI. Consult a Financial Advisor

If affordable, consulting with a financial advisor can significantly improve your ability to spot buy-the-dip opportunities. Such professionals often have access to advanced analytical tools and insider knowledge, which can provide an additional edge in identifying promising investment opportunities.

Suffice to say, the task of spotting buy-the-dip opportunities is not one that can be approached haphazardly. It demands a structured routine and keen observation on the part of the investor. By adopting a long-term perspective, understanding your investments, regularly monitoring the market, utilizing technical analysis, employing dollar-cost averaging, and seeking professional advice, one can significantly boost their chances of spotting and capitalizing on these potential opportunities.