Based in the throbbing heart of today’s financial world, the stock market is proving once again just how unpredictable an entity it can be. The focus of this discussion lies primarily on the tumultuous events occurring in the tech sector, particularly centering on mega-cap stocks. These heavyweight stocks have recently been impacted by an unexpected wave of significant profit-taking, leading to a drastic tumble in their value. This event has left investors, analysts, and corporate giants scrambling to devise effective strategies to weather this financial storm.

Mega-cap stocks, including those from leading technology firms such as Apple, Microsoft, Amazon, Alphabet Inc., and Facebook, are among the most valuable and esteemed companies on the market, each holding a market capitalization of more than $200 billion. They are stocks that hold tremendous sway, and their performance is closely tied to the overall health of the stock market. Hence, a downturn in these companies can send ripple effects throughout the entire economy.

In recent times, these tech giants have been on a colossal bull run, generating significant returns for their investors. This rally was largely due to the accelerating digital transformation exacerbated by the COVID-19 pandemic, which has brought an increased dependency on digital platforms for both individuals and businesses worldwide.

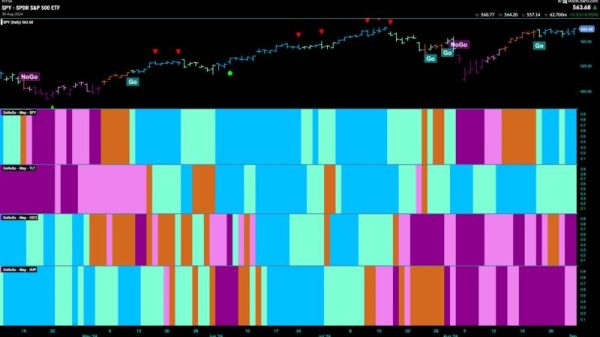

However, this profitability trend has taken an unexpected turn, with profit-taking hitting mega-cap stocks hard. Profit-taking, in essence, is the act of selling a security after it has become profitable. This happens when investors believe the price has reached its peak and decide to cash in on their gains.

With soaring share prices and inflated valuation multiples, these tech stocks had become a popular venue for profit-taking. A crowd of investors, eager to secure their gains before a potential market correction occurs, began selling their shares en masse. As a result, these previously sky-high performing tech stocks faced considerable downward pressure, leading to a substantial tumble in their value.

In an economy still grappling with the effects of the COVID-19 pandemic, this profit-taking spree has raised concerns among market analysts. It signals the investors’ lack of confidence in the continued growth of tech stocks, leading to a cautious and risk-averse stance. Many worry that the aggressive selling could lead to further market volatility and exacerbate the broader sell-off, placing further downward pressure on stock prices.

However, it’s essential to remember that the stock market is inherently volatile. Profit-taking, despite adversely affecting mega-cap tech stocks, is a common occurrence and should not lead to panic selling. Instead, it emphasizes the need for investors to diversify their portfolio, avoid over-dependency on a single sector, and continuously reassess their risk tolerance levels.

Overall, the sudden downturn of tech’s mega-cap stocks due to major profit-taking serves as both a vital reminder of the unpredictable nature of the stock market and an opportune learning moment for investors. It’s a testament to the necessity for shrewd investment strategies, careful risk management, and an understanding of market mechanisms, the lack of which can leave one vulnerable to rapidly changing market conditions.

In the grand scheme of things, while this event may present short-term challenges for investors and raise questions about the sustainability of tech valuations, it could also open up possible opportunities. As the age-old maxim of investing goes, Buy low, sell high. The dip in tech stocks could provide a promising entry point for potential investors looking to capitalize on these highly sought-after mega-cap stocks.