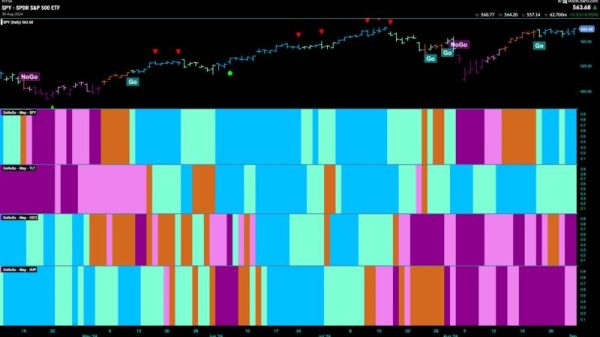

The S&P 500, one of the most important equity indices globally reflecting the U.S. stock market’s performance, tends to get a lot of attention. Its movements are closely watched by investors, traders, and financial experts worldwide. There has been an underlying sentiment that a sideways, or range-bound, movement for the S&P 500 can provide the best-case scenario within the financial markets landscape. This viewpoint may seem counterintuitive but carries substantial weight when explored in depth.

To begin with, it’s essential to understand what it means when we say that the S&P 500 is moving sideways. A sideways market is one where prices move within a narrow range for an extended period, without significant upwards or downwards trends. This stagnation allows the stock prices to move parallel to the time axis depicting little fluctuation and short-term volatility.

The primary reason why the sideways movement of the S&P 500 can be deemed as the best-case scenario revolves predominantly around market stability. The adage, ‘slow and steady wins the race,’ fits aptly. Volatility, characterized by sharp and frequent fluctuations in the S&P 500, can generate unease among investors. On the other side, a constantly soaring market might create a bubble that could burst and negatively affect investor sentiment and lead to substantial financial losses. Hence, a sideways market reflects a period of stability where the investors and the market gather breath.

In times of such neutrality, there’s an opportunity for investors to reassess their investments, study market trends, and rebalance their portfolio. It creates the perfect environment to get rid of volatile stocks and invest in those that provide stability. This period also allows investors to position themselves for the next big market move.

The sideways shift in the S&P 500 also keeps market valuations within a reasonable range, preventing overvaluation and undervaluation of stocks. It allows corporations time to grow their fundamentals to match their valuations, crucially reducing the risk of a financial bubble. Such careful and well-measured growth can establish a solid foundation for a sustained bull market, making a sideways S&P 500 highly beneficial.

Additionally, the sideways motion helps to cool down over-enthusiasm in the market. It gives market participants the chance to digest any news, earnings results, or economic indicators that could impact the market’s views on different stocks or sectors. This lull is necessary to avoid hasty decisions and promote thoughtful investing.

Moreover, options traders, in particular, can benefit from a sideways S&P 500. Given that options can be used to generate income through various strategies when the underlying instruments are range-bound, a sideways moving S&P 500 provides a lucrative opportunity for options traders to profit.

Ultimately, a sideways-moving S&P 500 offers market stability, provides investors with an opportunity for portfolio reassessment, keeps stock valuations in check, cools market sentiment, and presents a well-strategized benefit for options traders. While it might not seem as exciting or newsworthy as bullish runs or bearish downturns, the sideways movement of the S&P 500 could indeed be the best-case scenario for a balanced and sustainable financial market.