When it comes to hedging against inflation or financial uncertainties, many investors turn to the spot market for gold. However, as is the case with most commodities, the price of gold is highly volatile and tends to fluctuate on a daily basis. That volatility creates a pressing question: how high can gold prices go? Attempting to predict market movements is no easy task, but certain tools and economic indicators can help you spot the next big breakout in gold prices.

As you bear in mind the prospect of gold prices rising higher, you need to understand the factors that influence price movements. Notably, gold prices are driven by supply constraints, demand from emerging markets, global economic indicators, and geopolitical events. When demand is higher than supply, gold prices tend to increase. Less economically viable mining operations imposing higher extraction costs that limit new supply, coupled with rising demand from growing economies such as India and China, often give a boost to gold prices.

To spot the next big breakout of gold prices, it is important for investors to leverage certain tools. Monitoring the economic indicators that influence the price of gold can give you invaluable insights. These indicators include inflation rates, interest rates, and the US dollar index. Typically, gold prices rise when inflation is high since investors see gold as a means of preserving wealth. Similarly, gold often performs well when interest rates are low since it offers a better yield compared to other investment vehicles such as bonds.

Likewise, using technical analysis tools, such as chart patterns, can help an investor predict the market’s next move. Chart patterns often repeat themselves, offering clues about future price movements. The most common chart patterns used by gold investors include the head and shoulders, double tops and bottoms, and bull and bear flags. For example, a head and shoulders pattern could indicate a possible market reversal, while a bull flag might suggest an upcoming bullish market.

Besides, a plethora of online tools are available to analyze gold prices. These tools can provide real-time market data, historical price trends, and expert analyses. Some popular platforms include the World Gold Council’s market updates, the Bloomberg Commodities Index, and BullionVault’s live gold price chart. Gold forecast tools are also essential in keeping an eye on market trends and offering predictions on price movements.

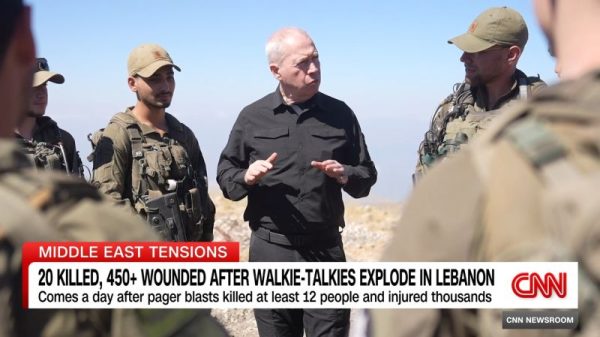

Furthermore, monitoring the news and staying informed about geopolitical events can also prove helpful. Gold, being a safe-haven asset, can be strongly influenced by international tensions, crises, and uncertainties. Whether it’s trade wars, conflicts, or pandemics, these upheavals tend to drive up the price of gold as investors seek safety in precious metals.

Social Sentiment Analysis is another tool that aids in predicting gold prices. It revolves around analyzing public sentiment on platforms like Twitter, Facebook, blogs, and news websites. The overall mood or sentiment can impact the buying and selling of gold. For instance, if the market sentiment leans towards fear and uncertainty, investors might flock to gold ad its price will rise.

In conclusion, predicting how high gold prices can go might seem impossible, but equipped with the right tools, the process can be less speculative and more grounded on perceptive management of a range of economic indicators and data analysis tools. Ultimately, the journey to invest in gold successfully goes beyond just asking how high can gold prices go? It’s about staying informed, making smart decisions, and employing the right set of tools to analyze market trends and data.