Analyzing DELL and PLTR in DP Trading Room

Firstly, let’s begin by diving into the stock market dynamics of Dell Technologies Inc. (DELL). This multinational company, known for its wide range of computing products and services, has been winning attention from investors for the robust performance of its stocks in the S&P 500 index.

Dell Technologies holds a strong market position, founded on its high-quality product portfolio, continuous expansion meshed with strategic acquisitions, and a committed customer base. These aspects greatly contribute to the financial strength of DELL. Recently, the organization delivered a stellar quarterly earnings report that exceeded Wall Street’s expectations. A majority of analysts believe the company’s flourishing cloud-based solutions and persistence on growing its software business will push it forward.

Despite facing severe market competition and challenges brought by global supply chain disruptions, DELL is tenacious. The company successfully anticipates and adapts to these challenges, which is evident in its strong economic moat. It is also boosted by the increasing demand for remote working equipment and technologies triggered by the COVID-19 pandemic. Investors keen on technology stocks should closely watch DELL’s movement in the S&P 500 index.

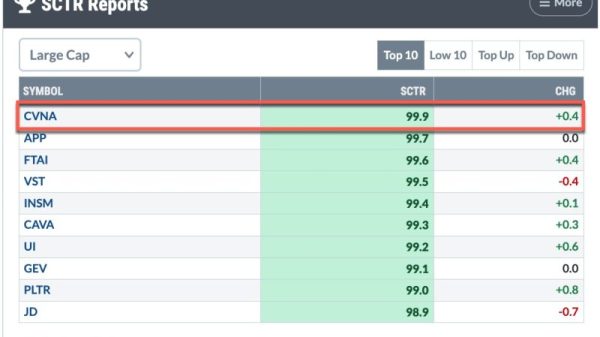

On the other hand, we have Palantir Technologies Inc. (PLTR). Relatively newer to the S&P 500, this software company specializes in big data analytics. Founded in 2003, Palantir has supported numerous government sectors and private entities with their advanced analytical software. Their inclusion in the S&P 500 accentuates their skyrocketing growth and burgeoning reputation in the tech market.

PLTR’s growth has been impressive, with contracts from distinctive sectors driving its top line. The company’s government contracts, especially those related to defense and intelligence services, provide a reliable revenue stream. In the private sector, its clientele stretches across diverse industries, including healthcare and manufacturing. Future investors are fascinated by its capability to deliver tailored solutions to complex issues, and the management’s initiative to invest in growth opportunities should not be overlooked.

However, like any other tech stock, PLTR is not without its risks. Financial analysts warn about overdependence on government contracts, which could threaten revenue if these relationships falter. The industry is also notorious for its quick-paced innovation, meaning Palantir must continually evolve or risk being left behind. Nonetheless, compared to where it was at the time of its IPO, Palantir is steadily growing its market share and is a potentially lucrative choice for investors looking toward robust tech stocks.

Dell Technologies and Palantir Technologies present considerable investment opportunities in the S&P 500, showing promise amidst market fluctuations and competitive challenges. Their stock performances must be meticulously scrutinized with a keen eye on market trends, sector dynamics, and individual company growth potential. Both DELL and PLTR offer intriguing prospects for investors who understand the inherent risks and rewards of trading in technology stocks. Moreover, the substantial influence of these stocks on the S&P 500 menu speaks volumes for their market reputation and potential growth.