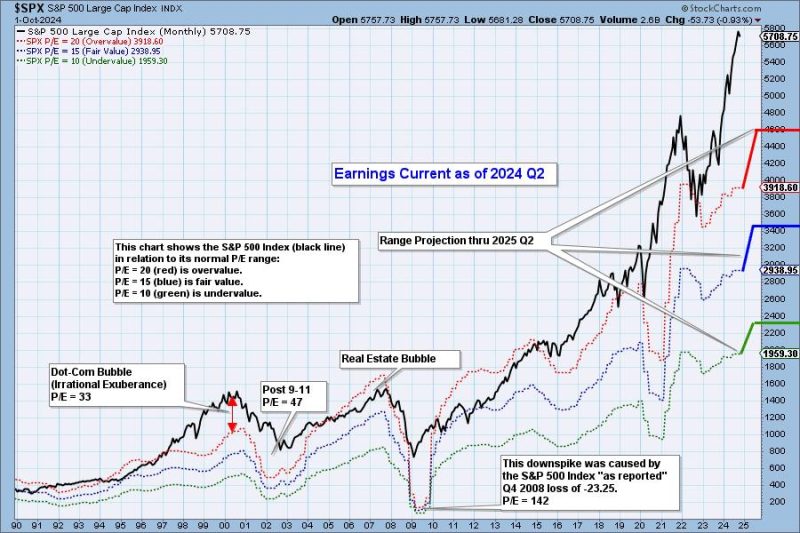

The 2024 Q2 earnings have been released, bringing a wave of mixed reactivity across the markets. Investors, market analysts, and economists all had keen anticipation of the quarter’s financial results sparks intense discussion and, at the same time, remind us of the pervasive overvaluation that characterizes the present economic situation.

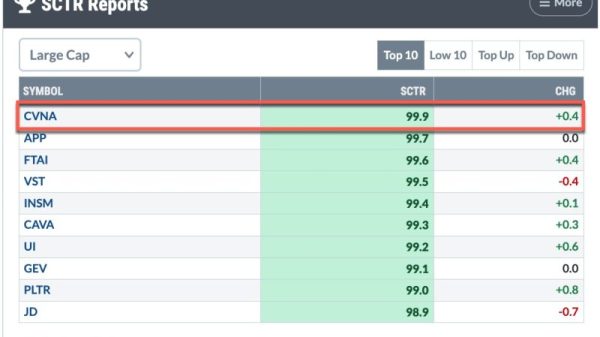

To begin with, it’s noteworthy that several industry giants reported their quarterly earnings above the consensus estimates. This robust performance, driven by strong sales, cost management strategies, and ongoing recovery from the global pandemic, has brought significant capital inflow into the markets. Some of the beneficiaries are the technology, consumer discretionary, and healthcare sectors, which all witnessed impressive growth.

In the technology sector, companies like Amazon, Google, and Microsoft saw soaring revenues, mainly attributable to the growing demand for remote work, e-commerce, cloud computing, and digital services. The consumer discretionary sector, thanks to the emphasis on home renovation, online shopping, and healthy eating during the global pandemic, saw a sales boom, enhancing giants like Home Depot and Amazon’s earnings. As for the healthcare sector, the continuous battle against the pandemic and the progress in telehealth added to their earnings.

Despite these robust earnings and their subsequent boost to investor confidence, the fact that stock prices were already at high levels explains why stock market indices have not moved dramatically upward. This continuing trend of persistent overvaluation potentially threatens future business cycles and overall market stability.

Upon closer analysis, several factors are driving this overvaluation. First, record-low interest rates continue to drive investors toward equities. With bond yields remaining unattractive, the influx of cash into the equity market has caused an artificial rise in stock prices. Equally important is the immense liquidity pumped into the economy by central banks across the globe in an effort to prop up the economy during the height of the pandemic. This flush of liquidity, while necessary, has led to inflated asset prices.

However, it’s essential to mention the role of investor sentiment and market speculation in the ongoing overvaluation. The optimism surrounding the economic recovery and the eagerness to capitalize on this recovery have resulted in investment decisions that are out of step with company fundamentals and economic realities. This optimism, coupled with speculative trading, especially in meme stocks and cryptocurrencies, has added more froth to the already overheated market.

Furthermore, there are also increasing concerns about the unbalanced nature of the market recovery among sectors. The aforementioned industries are far outstripping others such as energy, industrial, and financial services sectors. This uneven recovery contributes to inflated stock values and further exacerbates existing market imbalances.

Despite the exceptional Q2 earnings for 2024, the market remains significantly overvalued. This overvaluation is being fueled by various factors ranging from low-interest rates and excessive liquidity to investor euphoria and speculation. This discrepancy poses grave risks for investors and the broader economy, with potential for sharp corrections that could disrupt the market, particularly if these systemic issues are not addressed with urgency.

In summary, the 2024 Q2 earnings did reveal promising growth in some sectors, serving to strengthen investor confidence. However, these figures also shed light on an overarching theme that has been apparent for some time now – the market is very overvalued. Addressing this overvaluation and minimizing potential fallout is critical as it could shape economic trajectories in the coming years. Awareness and wise decision-making from stakeholders today can make a significant difference to the financial landscape tomorrow.