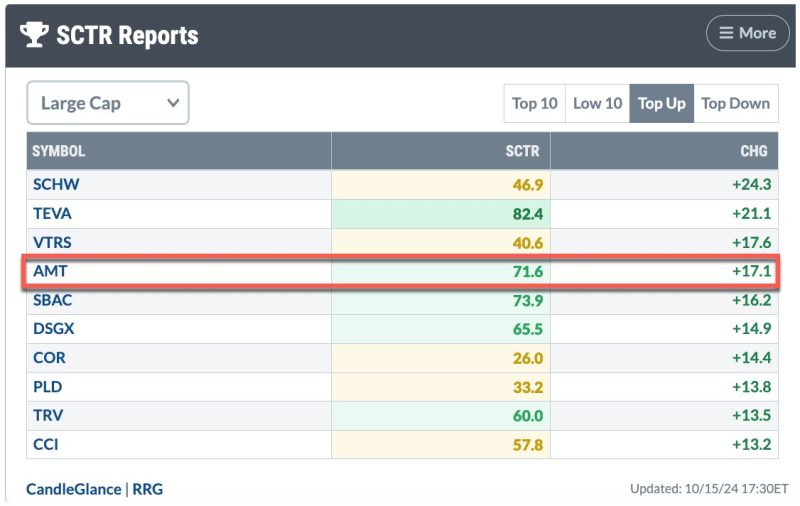

American Tower (AMT) is a leading player in the real estate investment trust (REIT) landscape, investing mainly in communication sites worldwide, including those in the United States, Asia, Europe, and Africa. In recent times, the company has demonstrated exceptional resilience, backed by consistent growth, which is reflected in its StockCharts Technical Rank (SCTR) report.

American Tower’s stock has been noted for its significant increase, signaling a potential breakout situation. This positive trend is largely due to the growing demands in the telecommunication industry, particularly in mobile and broadband sectors. American Tower has been able to make the most out of this opportunity, leasing its telecommunication spaces to various key players in the telecom industry.

One of the vital aspects of American Tower’s strategy is its focus on expansion. The company has consistently expanded its footprint, which now spans more than 180,000 communication sites worldwide. This growth has given the company a competitive edge in the market and allowed it to capitalize on the increased demand for mobile and broadband services.

There has been a consistent rise in the SCTR, indicating that the stock is gaining strength to move higher. The SCTR meter, a comprehensive technical performance measure, ranks stocks based on their relative strength. The latest SCTR report ranks American Tower, with a current SCTR value of 75.6, which indicates that the stock’s performance is better than 75.6% of stocks in the market.

The recent surge in American Tower’s SCTR report signifies a potential breakout in the offing. This is an ideal opportunity for prudent investors who are looking for viable investment options that offer significant returns. The emerging market conditions, specifically the boom in the telecommunications industry, have indirectly influenced the growth of American Tower’s stock.

Moreover, the financial outlook of American Tower seems promising, too. In the past five years, AMT stock’s EPS (Earnings Per Share) growth has exceeded the industry average, thus attracting investors.

American Tower’s 5G rollouts and its edge data centers’ launch have the potential of driving its revenue growth in the future. The increasing market demand for cloud-based applications, AI, and IoT (Internet of Things) services offer promising growth opportunities for AMT.

Stability is a critical factor for investors, and American Tower doesn’t disappoint in this regard. The company has consistently maintained steady revenue and profitability. Its business model of leasing communication spaces and its global footprint provide a solid foundation for sound financial performance.

In conclusion, the compelling SCTR report and the evident breakout stance of American Tower presents an attractive investment opportunity that should not be overlooked. With the company’s robust expansion strategy, the promising telecom landscape, and favorable market trends, American Tower certainly stands out as a promising investment prospect.