During market downturns, finding robust stocks can seem like a daunting task. However, by understanding specific techniques and employing shrewd strategies, investors can successfully unearth robust stocks in a weak market. These techniques revolve around smart choices, critical analysis, and shrewd decision-making on stock purchases.

The first method to uncovering strong stocks in poor markets is by understanding the fundamental analysis of the potential investment company. Fundamental analysis entails examining the company’s financials, industry standing, competition, and overall economic environment. Additionally, it’s also vital to look at the company’s income statement, balance sheet, and cash flow statement. As per the income statement, consistent revenue growth and solid net earnings are indicators of a robust company. On the balance sheet, investors should look at the company’s assets and liabilities. Companies with higher assets and lower liabilities are likely to weather downturns better.

Another piece to consider during fundamental analysis is the company’s earnings per share (EPS) and the Price/Earnings (P/E) ratio. Ideally, a strong company experiences consistent growth in EPS. If a company’s P/E ratio is below the industry average but it boasts repetitive EPS growth, that could indicate an overlooked and potentially strong investment during a weak market.

The second method for finding strong stocks in weak markets involves analyzing a company’s market position and its competitive advantage. Investors should focus on businesses with strong brand recognition, excellent management teams, and proprietary technologies or products. Such competitive advantages or ‘economic moats’ protect companies from rivals and buffer them during industry-wide downturns. Companies with significant competitive advantages are more likely to remain resilient and profitable during weak market conditions.

The technique of dividend investing is also a formidable strategy during poor markets. Companies that pay regular and increasing dividends are often mature, profitable, and financially healthy. These dividends can help to cushion the fall in price during weak markets and reward patient investors who hold onto their shares through downturns. Investors should search for companies with a steady history of paying dividends, indicating their consistent income generation.

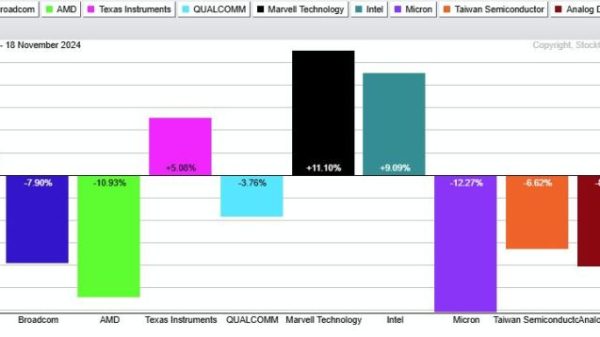

To effectively pinpoint strong stocks in soft markets, investors also need to understand and monitor sector rotations. During a bear market, certain sectors that are considered ‘defensive’ can outperform others. These sectors include utilities, healthcare, and consumer staples, as demand for their products or services remains relatively stable regardless of market conditions.

Risk management is another aspect that investors need to consider. Spreading your investments across diverse sectors can shelter your portfolio from significant short-term losses from any one industry. The key is to strive for balance so that the strong sectors can compensate for the weak ones during downtimes.

Lastly, an often overlooked but relevant aspect of finding strong stocks in a weak market is the human psychological factor. Fear can drastically impact market outcomes, prompting hasty decision-making. But for the discerning investor, market lows can provide opportunities to buy strong stocks at discounted prices. Thus, it’s essential to maintain perspective during tumultuous times, examining individual stocks on their merits and not getting swayed by prevailing market sentiment.

In conclusion, while the task of finding strong stocks in a weak market may seem overwhelming, armed with these strategies and the willingness to delve deep into insightful analysis, it is indeed feasible. Hence, never underestimate the potential that lies hidden in tough times. With the right approach, you can uncover strong stocks that can weather the storm and come out stronger, proving to be valuable assets in the long run. Remember, every weak market offers a unique opportunity to the savvy investor willing not only to survive but thrive.