The third quarter of 2024 continued to see dynamic developments on the global stage that significantly affected uranium prices. With key trends, geopolitical dynamics, and shifts in supply and demand driving the evolution of the uranium market, a comprehensive analysis provides useful insights for stakeholders.

One of the key highlights of the Q3 2024 review has been the resurgence of global nuclear power. This era’s ‘nuclear renaissance’ has led to a spike in utility demand for uranium, thereby putting upward pressure on uranium prices. Countries like China, India, and emerging markets in Southeast Asia and Africa have announced significant expansion plans for their nuclear energy programs. For instance, as part of its strategy to achieve carbon neutrality by 2060, China declared it will increase its nuclear power output by 20% through 2030. These plans have added a demand-side impetus to uranium prices, particularly as nations transition towards sustainable and zero-carbon energy sources.

However, the supply side of the equation has introduced unique dynamics to uranium pricing in Q3 2024. Several major mines, such as Cameco’s Cigar Lake mine in Canada and Kazatomprom’s operations in Kazakhstan were ramped down for maintenance and upgrades. Alongside this, new discoveries of uranium deposits were relatively fewer, leading to speculation about potential supply constraints. Moreover, environmental concerns and regulatory challenges continue to curb the exploration and extraction of uranium, causing further supply restrictions. This situation has maintained the upward momentum in uranium prices that began earlier in 2024.

Geopolitical factors also played a substantial role in uranium price dynamics in Q3 2024. The escalating tensions between Russia and Ukraine had a notable impact on the uranium market. Russia, being one of the world’s top producers of uranium, witnessed several disruptions in its supply chains due to the political instability. This led to uncertainty about the global supply of uranium, subsequently driving up prices.

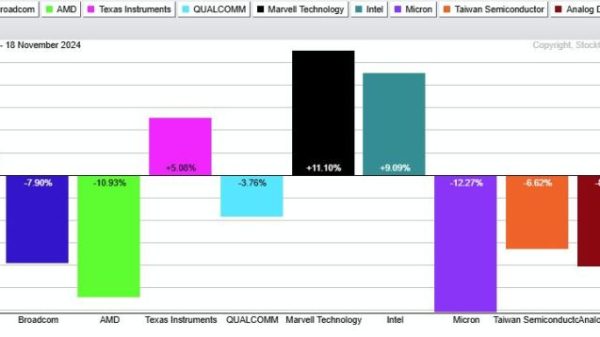

Notonly were there fluctuations from demand and supply, but the financial markets also influenced the uranium price trends. Q3 saw an increased interest from speculative investors and hedge funds in uranium stocks and exchange-traded funds (ETFs). The attractiveness of uranium as an investment vehicle rose due to its strong performance amidst volatile markets, thereby contributing to the price increase.

The pricing strategies of major uranium companies have also been a significant contributing factor. Companies have, in many cases, held back production to prevent an oversupply of uranium in the market. instead, they focused on offloading their existing inventory, which was bought at lower prices, to capitalize on the higher market rates. This strategy has contributed to tightening the market balance and pushing the prices up.

Lastly, the conversion of various unused nuclear warheads into nuclear fuel under the Megatons to Megawatts program continues to contribute a significant amount of supply to the market, albeit at a waning pace. The gradual reduction of this source introduces an additional factor of uncertainty for future uranium availability.

In summary, the third quarter of 2024 has been an exciting period for uranium price trends, driven by a complex mix of global, geopolitical, and market factors. The increase in demand for nuclear power, supply disruptions, political tensions, attractive investment opportunities, and strategic decisions by top uranium companies are major elements that defined the uranium price dynamics. The continuing trend of countries leaning towards nuclear energy for their sustainability goals will likely keep this market lively and dynamic in the foreseeable future. Overall, these multiple forces at play indicate no clear direction for uranium prices, underscoring the need for stakeholders to stay vigilant and informed in this constantly evolving market.