The global market has been roiled by widespread shifts in the economic structure owing to various global events such as the ongoing COVID-19 pandemic. This has led several market trend models to flash short-term bearish forecast, predicting a potential decline in market prices. How investors decide to navigate their way through this forecast depends largely on understanding the factors that triggered it and its imminent implications.

To start with, let’s delve into understanding what a bearish trend means. In financial parlance, a bearish trend occurs when the prices of securities are falling, and widespread pessimism causes the negative sentiment to be self-sustaining. This market situation provides savvy investors with unique opportunities to recalibrate their portfolios to leverage prevailing market conditions.

So what led to this bearish market prediction? Numerous factors can trigger a bearish market, including political instability, economic depression, or widespread company failures. Nowadays, the economy has been significantly disrupted by the COVID-19 pandemic. Several businesses faced unprecedented challenges during the pandemic and are still struggling to bounce back, leading to a bearish market trend.

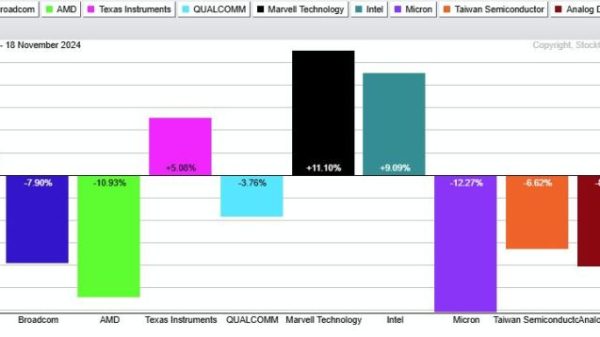

One of the most significant signals indicating this bear market is the behavior of the major market indexes. For instance, if market indexes like Dow Jones, NASDAQ, or S&P 500 embark on a downward track, it could be a harbinger of a bear market. Additionally, if economic indicators such as GDP or employment rates start to trend down, this could signal a downturn. Presently, many market trend models are flashing short-term bearish due to these indications.

Understanding these pointers is just a part of the plan; the real challenge lies in deciphering what comes next. Predicting the market’s future, particularly in the short term, is more an art than a science. However, there are a few strategies and moves that can be potentially beneficial in a bear market.

One key strategy would be investing in defensive stocks. These are stocks from companies that provide essential services (like utilities or consumer staples) and generally remain stable during market downtimes. Gold is another asset that has traditionally performed well in bear markets due to its reputation as a safe haven.

Another strategy is staying invested. While a bear market might seem like a good time to sell and cut losses, history has shown that markets do bounce back. If an investor sells during a downturn, they may miss out on the potential growth when the market recovers.

It’s important to remember that short-term bearish signals do not necessarily mean disaster. Rather, they offer an opportunity for investors to regroup, reassess and strategically plan their portfolios. The bear market can serve as an advantageous period for investors ready to capitalize on the opportunities that it holds.

Market fluctuations are as inevitable as they are unpredictable. By understanding what prompts such occurrences, investors can better prepare themselves and their portfolios to weather the storm and even capitalize on it. Investing wisely by considering various factors and adapting to changes will indeed increase the chances of gaining positive returns on investments, even in bearish markets.

Ultimately, remaining perceptive of market trend models, flexible in investment strategies, and patient in reaping outcomes are vital skills for every investor to weather the short-term bearish storms and conquer the investment horizon.