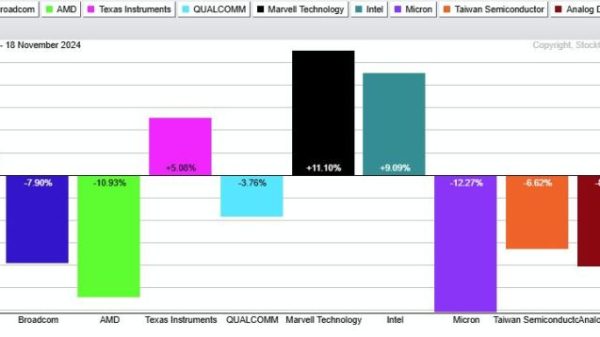

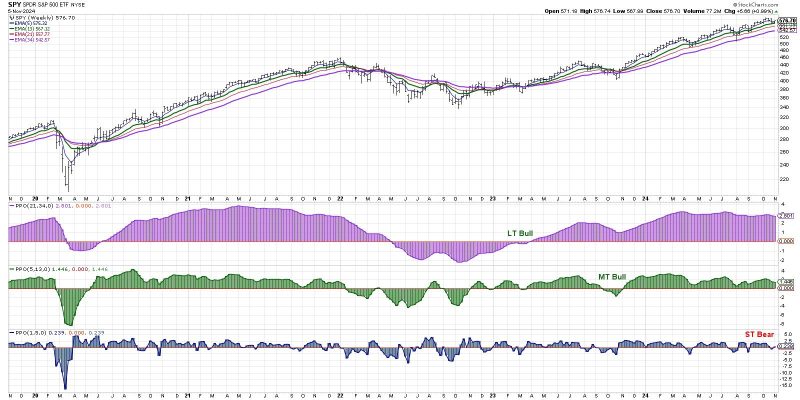

Heading into a news-heavy week, markets are showing signals indicative of a short-term bearish trend. As an investor, it’s vital to consider these early warning signs and take adequate measures to safeguard your investments against potential downdraws.

A bearish signal in the financial market indicates that an asset’s value is expected to decline. It is a phenomenon that suggests that the bulls are losing control, and the bears are taking charge. This scenario often cultivates an atmosphere of uncertainty and fear among investors who must brace themselves for possible losses.

Several indicators might be signalling a short-term bearish trend as we prepare for a news-rich week. One of the most reliable among these indicators is the Moving Average Convergence Divergence (MACD). The MACD takes two trend-following indicators (moving averages) and transforms them into a momentum oscillator by subtracting the longer moving average from the shorter one. A bearish signal is generated when the MACD falls below the signal line.

Another robust indicator of a short-term bearish trend is the Relative Strength Index (RSI). This indicator is used to gauge the recent price changes to evaluate whether a stock or a market is overbought or oversold. An RSI above 70 generally indicates an overbought, or bearish, market.

The imminent news-heavy week could trigger a bearish market due to several reasons. Important economic data releases, central bank decisions, or geopolitical events can cause sudden market swings, often favouring the bears. Investors tend to react to new developments quickly, and their sentiment can turn negative based on the news, causing a rush to sell and pushing prices down.

In anticipation of such a week, investors should consider reducing their portfolio’s risk level. This could be achieved by implementing a variety of strategies such as increasing the cash allocation, investing in defensive stocks or considering options for hedging.

Increasing cash allocation involves reducing your exposure to risky assets and holding more cash. This strategy provides you with the liquidity necessary to buy undervalued assets after the bear market has caused prices to drop.

Defensive stocks are shares in companies that provide essential services or products that people will continue to buy regardless of economic conditions, such as utilities or consumer staples. These stocks tend to hold their value well during bearish markets, providing a degree of protection for your portfolio.

Finally, options can be used to hedge against potential losses in a bearish market. Put options, for instance, give you the right (but not the obligation) to sell a specific asset at a predetermined price within a certain time frame. In a declining market, these options increase in value, offsetting losses from your other investments.

In conclusion, while a news-heavy week might cause short-term bearish signals, it doesn’t necessarily translate into long-term losses. By closely monitoring the market indicators and taking necessary precautions, investors can weather these downturns and potentially profit from them in the long run.