First Method: Tracking ETF Performance

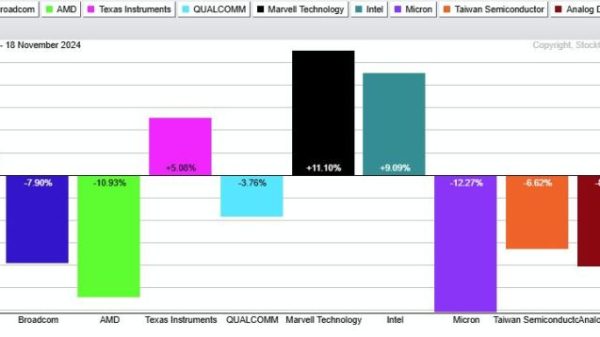

Exchange-Traded Funds (ETFs) are a popular tool among investors for tracking sector rotation. ETFs are investment funds that can be bought and sold on a stock exchange, similar to traditional stocks. What makes ETFs an ideal tracking method is that they group together assets belonging to the same sector. Consequently, top investors can monitor the performance of an entire sector by merely observing the performance of its corresponding ETF.

Investors keenly watch ETF price movements, volume changes, and relative performance comparisons with other ETFs. Doing so gives crucial insights into trends within various sectors. For instance, when ETFs related to a specific sector start outperforming others, it might indicate that a rotational shift in favor of that sector is impending.

Second Method: Observing Market Indices

Another effective strategy is tracking market indices. Top investors pay close attention to how indices representative of various sectors perform. These indices, such as the S&P 500’s various sector indices, represent a broad sector’s performance, incorporating an array of businesses within the respective sectors. If a certain sector index’s performance starts to eclipse others, it could suggest a sector rotation.

Additionally, observing the performance of broad indices in relation to narrower indices within a sector can also indicate rotation. For example, if a tech-specific index starts outshining the broad S&P 500 index, investors may conclude that money is rotating into the tech sector.

To enhance accuracy, top investors often combine market indices analysis with other strategies, such as fundamental analysis. This mixture assists in building a more comprehensive view of sector rotation.

Third Method: Utilizing Advanced Financial Analytics Tools

The third way through which top investors track sector rotation is by exploiting advanced financial analytics tools. Several professional-grade financial software programs on the market offer mechanisms to track and analyse sector rotation. These tools utilize complex algorithms to analyze a plethora of data points and reveal trends hidden from the naked eye.

Such tools often represent rotation trends graphically, allowing investors to visualize the flow of money between sectors. One popular representation is the Sector Rotation Wheel, showing sectors’ performance relative to each other over time. Advanced software also offers features like real-time tracking and predictive analytics, giving investors an edge in identifying impending sector rotations.

In conclusion, tracking sector rotation is pivotal to stay ahead in the fast-paced investment world. Methods such as carefully monitoring ETFs, scrutinizing market indices, and using advanced analytics tools, can help investors to identify profitable opportunities that arise from it. Each of these approaches has its advantages and disadvantages, and often they are most powerful when used in combination. Ultimately, successful sector rotation tracking relies on keen observation, careful analysis and a systematic investment strategy.