The Palantir Trade Follow-Up is a comprehensive reflection of the transformative power of integrating insights into actions that drive investment decision-making. It illustrates the impelling need for a systematic approach to asset journey visualization and leveraging robust quantitative data for better informed and insightful analysis.

To begin with, the Palantir Trade Follow-Up is a direct product of the unveiling of Palantir’s SCTR Report. The StockCharts Technical Rank (SCTR) Report is a ranking system that measures the technical strength of stocks, ETFs and indexes. With Palantir notably among its ranks, the resultant utility of the report is unmistakable.

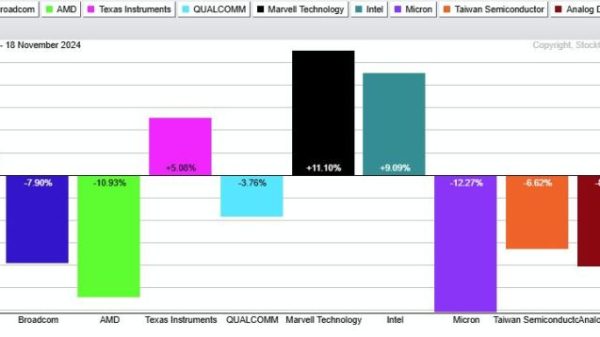

Using detailed technical analyses and market trend assessments, the Palantir Trade Follow-Up offers a clear and comprehensive perspective of the company’s financial standing, tracking its performance and identifying investment opportunities. It presents an array of statistical data in a digestible manner for potential investors, brokers and market analysts. It deep dives into specific metrics such as trading volumes, volatility and returns to measure the attractiveness of an asset.

Moreover, the Palantir Trade Follow-Up predominantly stands out due to its core focus on ‘transforming insights into actions’. Primarily, it elucidates how fact-based analyses can facilitate strategic decision-making in the capital market landscape. It suggests that companies like Palantir are making bigger strides in surging their stocks, largely due to relying on the intersectionality of market intel and their individual data.

One of the distinctive features of the Palantir Trade Follow-Up is its emphasis on constant market monitoring. It clearly emphasizes that timely actions driven through insights culled from the SCTR report can lead to substantial results. By interpreting intricate data sets for meaningful outcomes, investors can negotiate the market terrain more assertively, reducing errors and maximizing gains.

The Palantir Trade Follow-Up also heralds the robustness and versatility of Palantir’s proprietary technologies and platforms. It recommends leveraging real-time AI-driven predictive analysis to foster strategic decisions in a fast-paced market. Investors are given tools to visualize complex market trends and data streams. All these, which closely align with the ethos of the Palantir vision, help it stand out amongst competitors.

Moreover, the report goes beyond mere theoretical insights and offers practical applications. For instance, it demonstrates how daily monitoring of the SCTR ranking, coupled with an understanding of the company’s financials, can optimize investment choices. It essentially harbors the outlook of a proactive investor keeping pace with the dynamic nature of modern trading.

Finally, the Palantir Trade Follow-Up reiterates the significance of designing a systematic approach to trading. This approach underscores the criticality of thorough market research, equally balanced by the understanding of complex analytics and real-time monitoring mechanisms.

In the final analysis, the Palantir Trade Follow-Up transcends the boundaries of traditional investment methods. Its commitment to converting insights into decisive actions solidifies its position as a revolutionary player in today’s data-driven trading environment.