Understanding the phenomenon of stock outperformance is essential for any investor or individual interested in capital markets. Over the years, certain stocks have demonstrated exceptional growth compared to others, creating significant wealth for investors who identified and invested in them. This notable trend of stock outperformance has been a promising sight, but it might be coming to an end. Let’s delve into the reasons behind this potential shift.

Firstly, the current economic climate is changing rapidly, largely due to the global pandemic and its aftermath. Unprecedented events like these have brought about a significant shift in the way businesses operate and will continue to operate in the future. Companies that were previously outperforming may not be in a position to adapt as quickly to these changes, and as a result, may fail to maintain their high growth rates.

This brings us to the next point: technological disruption. With the surge in digital transformation, emerging technologies have become significant market disruptors. Companies that fail to embrace this change and evolve with it can quickly find themselves outpaced by their competitors. As a result, companies that were once stock market darlings may lose their charm if they cannot keep up with technological advancements and industry trends.

Next, the issue of monetary policy cannot be overlooked when discussing stock outperformance. Central banks around the world have implemented loose monetary policies to stimulate their economies since the 2008 financial crisis. Interest rates have been hovering close to zero, encouraging speculative behavior and investment in riskier assets like stocks. However, as central banks begin to hint at tightening their monetary policies to control inflation, the excessive liquidity in the market may soon be sucked out, causing overvalued stocks to correct.

Another concern is overvaluation. Some stocks have been trading at high multiples, far beyond what their fundamentals justify, due to extreme investor optimism. As investor sentiments shift and they start focusing more on valuation metrics, such stocks’ performance might begin to falter.

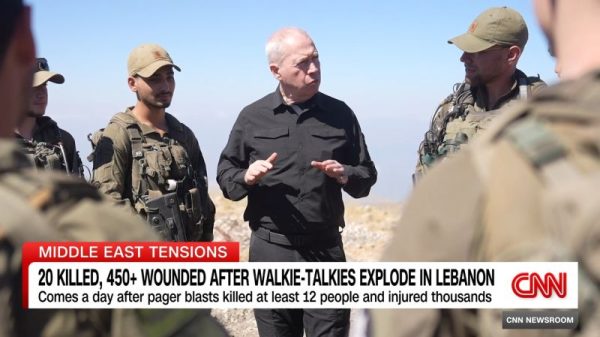

The geopolitical landscape is also shifting, causing increased uncertainty. From trade wars between nations to nuanced policies impacting international business, geopolitical risk can significantly weigh on the future prospects of previously outperforming stocks.

Lastly, regulatory environments are becoming more stringent. Several sectors, such as technology, are under intense scrutiny for potential monopolistic behavior, and strong regulatory action could negatively impact these companies’ future earnings.

In conclusion, while it can be tempting to rest on the laurels of past performance, it’s critical for investors to understand that the factors driving stock outperformance can shift. From significant macroeconomic change to industry-specific disruptions, multiple factors could be signaling the end of this trend. As such, comprehensive analysis and constant vigilance should be the approach in making investment decisions in this evolving landscape.