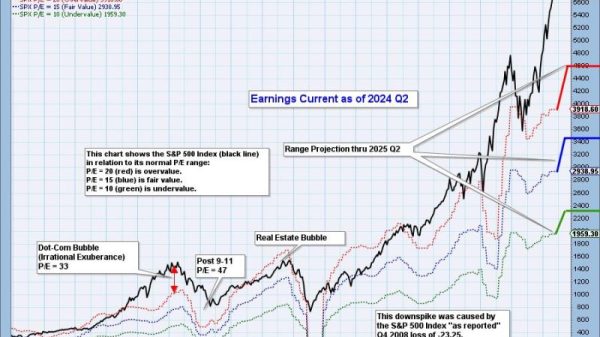

The pulse of the financial market has seen a significant shift as stocks strive to regain some of the broken grounds, amidst other impactful factors such as rising yields, gold prices, and the US Dollar. This article will delve deeper into the patterning layouts that are defining the new normal in the marketplace.

Arguably, the most resounding feature of the current stock market is the resilience shown by stocks recently—showing an impressive rebound after significant losses. The tumultuous climate that brewed up in the wake of the COVID-19 pandemic notched up a downswing in the performance of stocks globally. However, despite this destabilized state, stocks have exhibited signs of regaining ground, as investors gradually regain confidence.

One of the principal catalysts of this shift has been the rising yields. With long-term interest rates taking an upward trajectory, sector rotations have occurred, luring investors towards more attractive opportunities. Stocks associated with cyclical and value sectors have particularly benefited from this incline, seeing an increase in market demand. This positive trend has further stimulated stocks’ regain initiatives, underpinned by the optimism by market participants about future growth prospects.

Parallely, the gold prices have been consistently pacing up—implying a fundamental reassessment of asset allocation across portfolios. Traditionally construed as a safe haven investment, gold has been witnessing a surge, largely due to prevalent inflation expectations. This anxiously-watched trajectory of gold prices has honed market sentiment, thereby incentivizing stock investments. Gold-hoarding, in this case, serves as an antidote to potential risks, reassuring investors about its capacity to hedge against impending losses.

In addition to the rising yields and gold prices, the power momentum of the US Dollar in the currency exchange markets has been a significant factor influencing the stock market’s recovery. Despite sporadic episodes of turbulence, the US Dollar has largely been on a strengthening spree, signalling positive cues to the investors. The fundamental stability of the US economy, despite pandemic-induced challenges, has invited confidence among participants, thus enhancing its appeal for investment.

Further, reinforcing the impact of these incrementally rising yields, gold prices, and US Dollar developments is the consistent interplay between equities, bonds, commodities, and currencies. Each market movement sparks implications on the others, creating a complex web of interconnections that hold the potential to either buoy or dip the stock market. The increasing synergy between these instruments has been instrumental in providing a supportive platform for stocks, gradually clawing back their pre-pandemic stature.

In summary, the path to the recovery of stocks has been layered, with significant contributions made by rising yield rates, gold prices, and an uptrend in the US Dollar. Despite various market volatilities, these components have collectively orchestrated a favourable climate for a stock market comeback. While the journey towards complete recovery may still be long and fraught with uncertainties, the green shoots of resilience amidst adversity bear testimony to the robust fundamentals of the global financial markets.