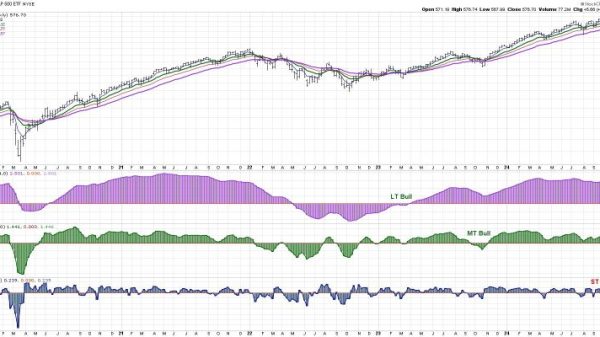

1. Moving Averages

One of the top breadth indicators that diligent traders should regularly leverage is Moving Averages, which are plotted on a chart to identify the current trend direction over a specific period. The most commonly used moving averages are the simple moving average (SMA) and the exponential moving average (EMA). The SMA considers the average closing prices over a specified number of sessions, while the EMA gives more importance to recent price data. These averages can help one cut through the daily swing of prices and reveal the underlying market trajectory. For better accuracy, when the moving averages from short-term (like 20 days) and long-term (like 200 days) durations are plotted together, it provides the trader with unique perspectives of the trend behavior.

2. Advance-Decline Line (AD Line)

The Advance-Decline Line, commonly referred to as the AD Line, is one of the most potent market breadth indicators that determine the number of advancing stock issues subtracted by declining ones. It’s useful in showcasing the health of a market trend. For instance, if this line trends higher, it shows that more stocks advance than decline which is often seen as bullish sentiment. Conversely, the falling AD Line signifies bearish sentiment. An AD Line diverging from the market’s trend may indicate a potential reversal, providing a clue for future market direction before it happens.

3. McClellan Oscillator

Developed by Sherman and Marian McClellan, the McClellan Oscillator is a momentum indicator derived from net advances, which is the number of advancing issues minus the number of declining issues. This oscillator helps reveal the strength of market money inflows or outflows. When daily market breadth is strong, the McClellan Oscillator will be a positive number and when daily market breadth is weak, the McClellan Oscillator will be a negative number. High positive readings beckon strong upward momentum, while low negative values indicate strong downward momentum.

4. On-Balance Volume (OBV)

On-Balance Volume is another excellent indicator of market breadth, revealing whether volume is flowing into or out of a security. The OBV increases when the close of the session is higher than the previous one and decreases when the close of the session is lower. If the OBV rises and forms an upswing together with price, this points to a healthy and positive market trend. A divergence between the OBV and the standard price trend may signify a potential price reversal, thus acting as a trigger or warning for market participants.

5. Arms Index (TRIN)

The Arms Index, also known as TRIN (Trading Index), is a unique breadth indicator which assesses the relationship between advancing and declining stocks, and their respective volume data. It’s crucial for identifying over-bought and over-sold conditions in markets. When TRIN is below 1, it means that the volume of advancing stocks is greater than the volume of declining stocks, and the market is considered bullish. When TRIN is above 1, the volume of declining stocks outpaces advancing stocks volume, indicating bearish sentiment.

Each of these indicators has its strengths, but using them in harmony can provide a robust system for mastering the market’s breadth. By incorporating these five breadth indicators into a comprehensive analysis strategy, traders and investors can make informed decisions about when to enter or exit the market, reducing risk and enhancing potential returns.