Market Overview

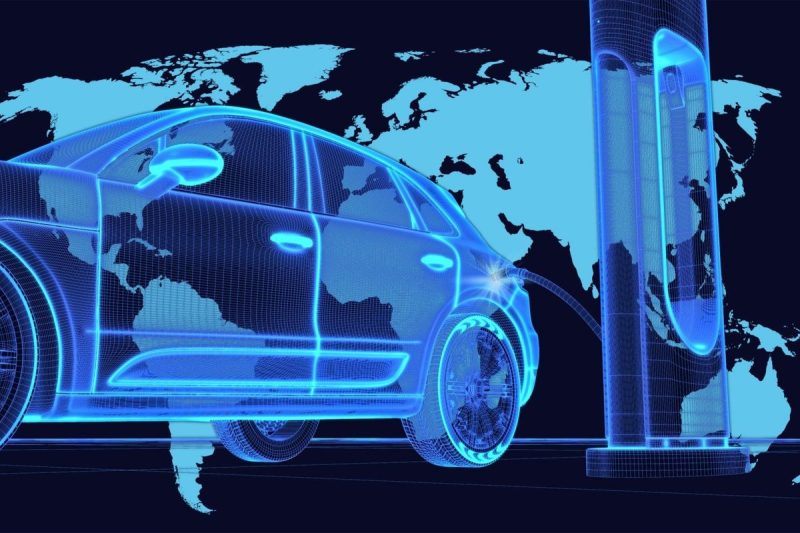

In Q3 2024, the cobalt market demonstrated impressive growth, showcasing a resilient recovery from the economic turmoil caused by the COVID-19 pandemic. This renewal was primarily driven by increasing demand from the battery industry, soaring electric vehicle (EV) adoption, and accelerating energy storage technologies.

Market Demand

Cobalt is a crucial component in the manufacturing of lithium-ion batteries, which are integral to handheld electronic devices, EVs, and other renewable energy storage systems. The global demand for cobalt in Q3 2024 significantly increased, primarily fuelled by the explosive growth in the EV market. Governments worldwide are encouraging green initiatives as part of their COVID-19 recovery efforts, leading to a surge in EV production and sales. This trend shows no signs of deceleration and is projected to further drive cobalt demand in the upcoming quarters.

Supply Chain Dynamics

However, the cobalt supply chain faced some disruptions due to geopolitical tensions, particularly in the Democratic Republic of Congo (DRC), which is responsible for approximately 70% of the world’s cobalt production. Despite these challenges, large mining companies have managed to sustain production levels. This resulted in a market condition where demand outpaced constrained supply, pushing cobalt prices even higher.

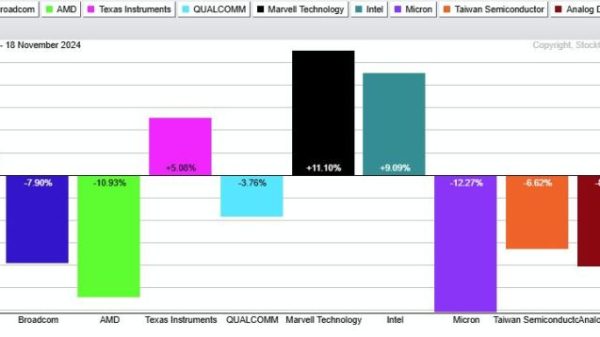

Price Fluctuation

The cobalt price saw a historical rise in Q3 2024, influenced mainly by the robust demand from the battery sector and supply shortages. It has been a quarter of unforeseen price hikes in the cobalt market, supported further by speculations around persistent supply-chain disruptions. Investors have kept a close eye on pricing trends, as the cost of cobalt impacts significantly on EVs’ final price.

Cobalt Mining and Ethical Sourcing

The ethical sourcing of cobalt has been at the forefront of discussions in Q3 2024. Numerous reports highlighted the use of child labor and poor working conditions in cobalt mines in the DRC. In response, industries, primarily the automotive sector, have been working towards supply chain transparency. A handful of companies have started investing in North American and Australian cobalt mines to reduce dependency on the DRC.

Market Innovations

Innovation in Q3 2024 has been centered around reducing the cobalt content in batteries due to cost and ethical sourcing issues. Major battery manufacturers experimented with different chemistries to cut down cobalt usage without compromising power output. Meanwhile, recycling of lithium-ion batteries has become a focal point for harnessing secondary cobalt, further providing a massive opportunity for technology and recycling companies.

In conclusion, despite a few hiccups, the cobalt market showed a strong upward trend during Q3 2024, something that is expected to continue in the future. It’s clear that advancements in EV technology, environmental policies, and the adoption of portable electronics are vital drivers in the cobalt market’s forecasted growth. Despite the realities of ongoing supply challenges and ethical sourcing questions, optimism surrounding cobalt’s demand and market dynamics prevails.