Understanding the Stock Market Post-Election

Post-election periods are often a critical time for stock markets as they react to the emerging political landscape. Depending on the policy framework embraced by the elected party, certain sectors may surge, while others may stagnate. This dynamic can provide savvy investors with a wealth of potential profit-making opportunities if they know where to look. Here’s how you can scan for post-election profit opportunities.

1. Identify Sectors That Will Benefit From Changes in Policy

One of the simplest ways to find post-election profit opportunities is to identify sectors likely to benefit from changes in policy. Typically, elected officials make numerous promises during their campaigns, and the stock market often responds favorably to sectors that stand to benefit from these pledges. A thorough analysis of the new administration’s policy framework can potentially spotlight lucrative investment opportunities.

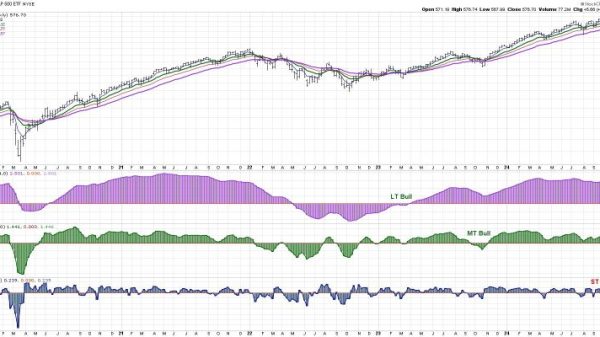

2. Monitor Market Sentiment

Stock markets are not just about numbers, they are also about sentiments. A change in political leadership could result in a swing in optimism or pessimism, affecting markets significantly. Ensuring you stay abreast of market sentiment by keeping up with news flow, investor reactions, and professional assessments can enable you to forecast potential future market moves.

3. Hedge The Risks

While scanning for post-election profit opportunities, it’s crucial not to overlook the potential for heightened market volatility. Elections are known to cause market uncertainty, which could impact your portfolio negatively. Consider hedging against such risks by diversifying your investments across various sectors, geographic markets, and asset types.

4. Watch Out for Investment Themes

After the election, new investment themes may emerge, reflecting the changing economic landscape. It could be cannabis, green energy, infrastructural development, or healthcare. Stay alert to these themes, as early investments could see considerable benefits when these sectors begin to grow.

5. Leverage Advanced Technology

In today’s modern age, technology is reshaping every aspect of our lives, including how we invest. Advanced stock screening tools can assist you in identifying stocks that meet specific criteria relevant to post-election market conditions. For example, you could use a screener to identify stocks in sectors favored by the new administration that are experiencing higher than average volume.

6. Pay Attention to International Market Influence

Domestic policy changes can have a considerable impact on international markets, particularly for countries that have significant trading ties with each other. If these policy changes are favorable to those countries, their stock markets could experience growth, presenting potential investment opportunities.

7. Understand The Impact on Currency Markets

Lastly, changes in political leadership can cause fluctuations in currency markets. If the currency strengthens as a result of investor confidence, stocks of companies that do a lot of overseas business can increase in value due to favorable exchange rates.

In conclusion, the changes and uncertainties following political elections can open up numerous profit opportunities for observant and patient investors. By understanding and closely monitoring the dynamics of the stock market, sectors, market sentiment, global influence, and currency rates, investors can position themselves to take full advantage of post-election market swings. Happy investing!