Seasonality charts provide potentially significant insights into the patterns of various industry sectors. These charts reveal the times when certain sectors flourish or falter, helping investors know the best time to buy or sell shares, thus leading to higher profits. Utilizing seasonality charts to identify trends in different business sectors can present opportunities to capitalize on historical trends. Below are a few sectors to keep an eye on, as revealed by seasonality charts.

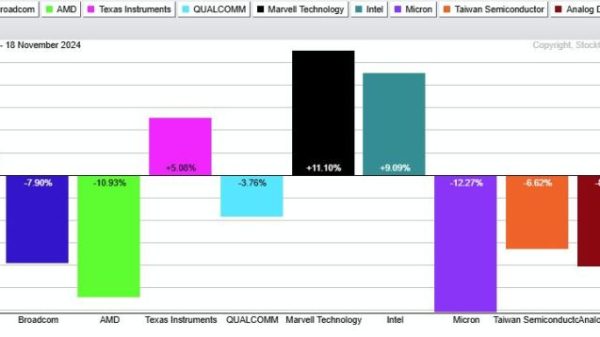

Firstly, the Technology Sector. Technology companies dominate the modern global economy with various up-and-coming firms burgeoning each year. Seasonality charts illustrate technology stocks often prosper in the spring months, particularly from February to April. During these times, investors are usually bullish on technology stocks. For instance, the Fidelity Select Technology fund has seen consistent growth during this period over the past decade. This is frequently due to significant product launches and the announcement of first quarter earnings.

Secondly, the Home Construction sector. The home construction industry also shows a strong seasonal trend. Historically, building companies perform well from January to March, as this aligns with the beginning of the construction season. Many consumers plan home improvement projects at the beginning of the year leading to increased demand in building materials and services. Moreover, construction stocks often perform well during this time to accommodate this rise. A good example is the SPDR S&P Homebuilders ETF which traditionally performs well during these periods.

Next, we have the Retail sector. Seasonality charts highlight a clear pattern of strength for retail stocks in late summer and early fall, a period often called the back-to-school shopping season. This seasonal buying period is only second to the holiday shopping spree. The SPDR S&P Retail ETF, for instance, has exhibited consistent growth during this window. During this period, retailers garner substantial revenue, as families refresh wardrobes and restock school supplies for the upcoming academic year, hence providing a boost to this sector.

Additionally, the Energy sector is another one to look out for. Energy stocks typically shine from February to May, with the approach of summer driving up the demand for gasoline, translating to elevated gas prices. The Fidelity Select Energy fund, for instance, has typically seen a modest boost during these months, a trend expected to continue due to rising energy demand linked to economic recovery from the Covid-19 pandemic.

Lastly, the Healthcare sector, which is quite interesting as its peak period isn’t consistent like others. Its performance tends to spike around June and November. The sector becomes particularly active in November due to the annual insurance enrolment period, and in June, as various bio conferences occur leading to many public announcements spurring investor interest.

While seasonality charts remain an integral tool for investors, it is crucial not to use them in isolation. Other factors such as the current economic condition, geopolitical events, or corporate news can have a significant impact on sectors and individual companies. Therefore, savvy investors take a holistic approach, considering seasonality trends as well as other critical industry data and global economic indicators when making investment decisions.

In conclusion, following seasonality charts can empower investors with historical perspectives on sector performance, opening up opportunities for potentially lucrative investments. The technology, home construction, retail, energy, and healthcare sectors all follow seasonal trends that warrant investors’ attention. However, remember that these seasonality patterns are trends, not guarantees. Always strive to combine these insights with careful, comprehensive market research to make informed investment decisions.