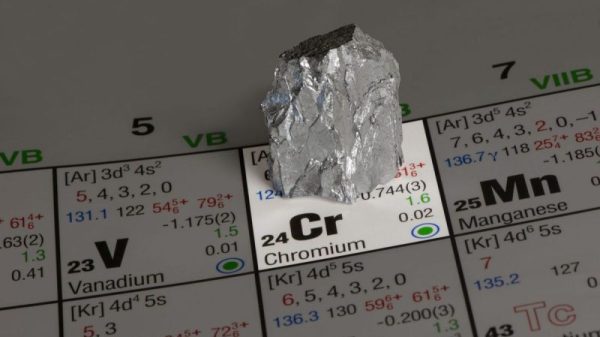

Understanding the Chromium Market

The first step in investing in chromium stocks is to understand the chromium market. Chromium, a transition metal, is a crucial ingredient in stainless steel, making it an essential commodity in various industries such as automotive, aerospace, and construction. Chromium also has applications in the tanning of leathers, the manufacturing of pigments, and as an essential element in dietary supplements.

In 2024, the demand for chromium remains robust due to the steady growth of the above sectors. However, the supply of chromium is somewhat concentrated, with South Africa, Kazakhstan, and India leading as the primary producers. This concentration can result in volatility in chromium prices. Investors, therefore, need to monitor not only the demand side but also shifts and geopolitics on the supply side that can potentially affect production and prices of chromium.

Identifying Potential Chromium Stocks

Like any other sector, considerable research must precede any investment in chromium stocks. Companies involved in chromium production or those that have a significant portion of their business tied to chromium, such as mining and extraction companies that also handle other metals, could be potential investments.

A solid way to identify which stocks to invest in is to look at the company’s performance history and future growth prospects. Check the financials of the company, the dividend yield, the market capitalization, and the price-to-earnings (P/E) ratio among other financial statistics to guide your decision.

Keep in mind that investing in individual stocks can carry more risk than investing in a diversified portfolio. Therefore, ensure that you understand the potential risks involved.

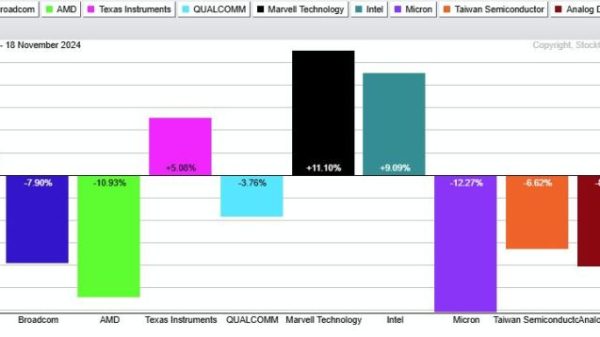

Analysis of Chromium Stocks

Analysing individual chromium stocks requires an understanding of both industry-specific and company-level factors.

Industry-level factors to consider include overall chromium demand, changes in global steel production, and shifts in chromium supply due to geopolitical events or mining disruptions. Keep an eye on global industrial trends that might affect the demand for chromium, such as the electrification of vehicles, which could boost steel and consequently, chromium demand, or the adoption of alternative materials that can reduce steel and, in turn, chromium consumption.

At the company level, examine the firm’s financial health, its profit margins, cost efficiency, and production capacity. Look at the competitive position of the firm – whether it has the advantages that can help it stand out amid competition and market changes.

ETFs and Mutual Funds

Another way to invest in chromium stocks without having to pick individual companies is through exchange-traded funds (ETFs) and mutual funds. Some ETFs and mutual funds focus on broad sections of the commodity market, including metals, and may have holdings that include chromium producers.

These investment vehicles offer diversification as they are composed of a variety of assets, reducing the risk associated as compared to investing directly in individual stocks. However, they also involve fund management fees and, in some cases, may not perfectly track the underlying index they are supposed to represent.

Using a Brokerage Platform

To invest in chromium stocks, you will need to use a brokerage platform. These platforms allow you to buy and sell stocks, ETFs, and other securities. Many brokerage firms also offer research tools, educational resources, and access to financial advisors, making them an excellent option for both beginners and expert investors.

Remember that each brokerage has its fee structure, trading features, research tools, and customer support. Therefore, you should choose one that fits your trading style and requirements the best.

Finally, always remember to consider your investment goals, risk tolerance, and investment horizon before investing in chromium stocks. Acknowledge the volatility of commodity markets and be ready to weather potential periods of market instability. As with any investment, there is the potential for both profits and losses, so it is essential to make well-informed decisions.