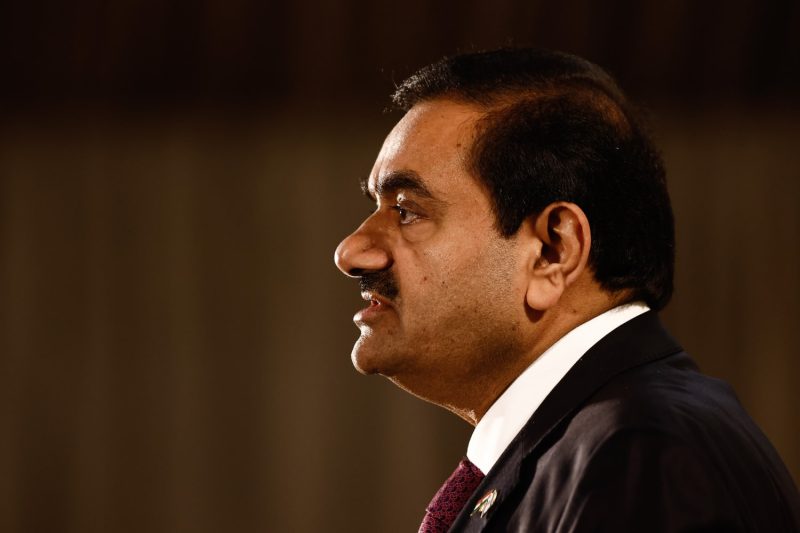

Unprecedented in the annals of white-collar crime, India’s second-wealthiest person has been indicted by the U.S. authorities in a bribery scheme amounting to $250 million. This has sent shocks waves not just through the South Asian nation but also across global business communities. The narrative below attempts to unpack the complexities of this intriguing saga.

The individual in question, a well-known tycoon whose name is withheld due to ongoing legal proceedings, commands a formidable empire spanning industries as diverse as technology, energy, and real estate. With a net worth estimated in the billions, he is second only to Mukesh Ambani, the chairman of Reliance Industries, in the list of wealthy Indians.

The indictment, filed by the U.S. Attorney’s Office in the Southern District of New York, alleges that the tycoon resorted to bribery amounting to hundreds of millions, with the intention of influencing high-ranking officials in a third-world country. The investigations suggest that this was allegedly done to secure lucrative contracts, property deals, and monopolistic control over certain sectors. This audacious flouting of ethical business norms and regulations leaves one pondering over the prevalence of corrupt practices within the global corporate setting.

Interestingly, the charges stem from the Foreign Corrupt Practices Act (FCPA), a U.S. federal law, which positions the U.S. as a watchdog against corruption happening anywhere in the world—a fact that further elevates the significance of these allegations. Being a U.S. legislation, the FCPA essentially has a global reach and hence permits U.S. law enforcement agencies to indict foreign nationals who get involved in unethical practices overseas.

The investigators have reportedly procured a plethora of documentary evidence, such as bank documents and communication records, detailing the flow of illicit payments. These transactions were purportedly disguised as ‘consulting fees’ or ‘commissions’ and channeled through a web of shell corporations organized in several tax havens.

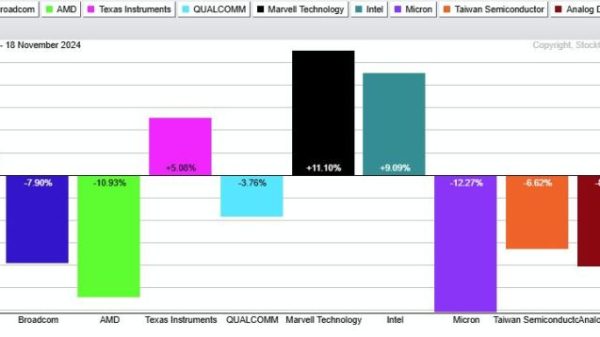

While the impact on the tycoon’s business empire is paradoxical, there’s a palpable fear that this scandal might lead to an erosion of investors’ faith in his conglomerate. The share prices of his listed companies have already started to slide downhill as investors reassess the risks.

Furthermore, the indictment draws the focus back on India’s chronic issue of corruption. While the country has made considerable progress in trimming off-the-books deals, the present case underscores the persistent problem and broad challenges against rooting out corruption. It also further highlights the necessity for stronger, more effective anti-bribery and corruption measures, not only in India but globally.

In another significant implication of this scandal, it illustrates the ever-increasing reach of American law enforcement in global affairs. It displays their faith in maintaining the transparency, accountability, and integrity of global commerce, which consequently has repercussions on foreign businesses and their operations.

The shocking indictment attests to an alarming level of corrupt practices. It is a grim reminder of the transformative work needed to ensure ethical functioning across the corporate world. As the global business community awaits further development, the case stands as a testament to the U.S. law enforcement’s promise to uphold integrity, and a lesson in compliance for corporations worldwide.